How To Value A Company Based On Net Income

Ask for Seller Financing. Buyers guided by appraisers and business valuation experts use rules of thumb to value businesses based on multiples of business earnings.

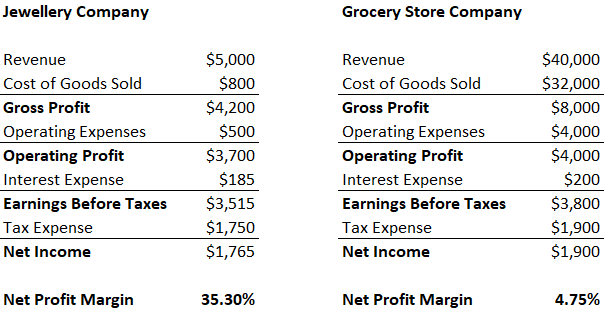

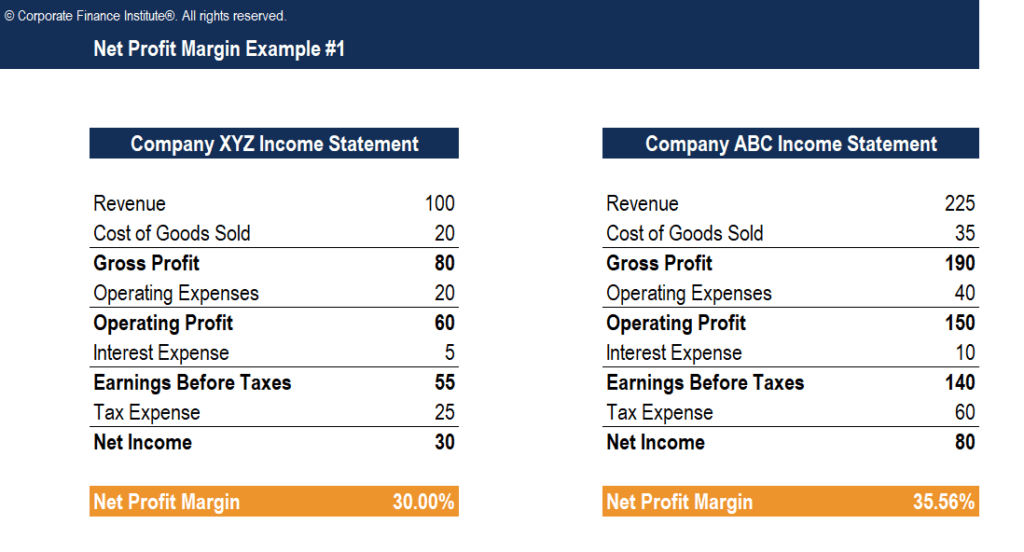

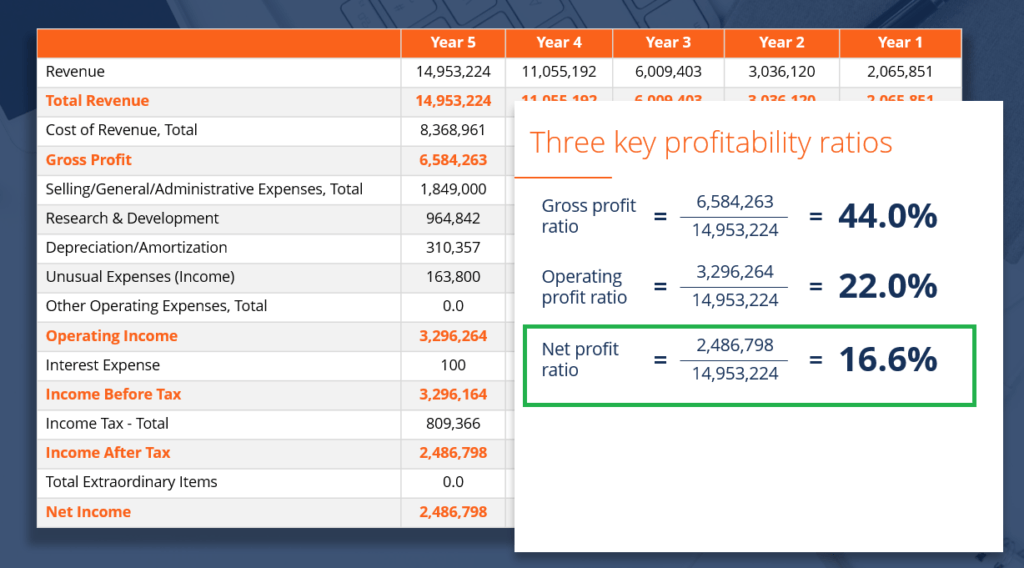

Net Profit Margin Definition Formula And Example Calculation

Lets say your comparable sold for 250000.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-b54b46188f5746769a37298478048177.jpg)

How to value a company based on net income. However it looks at a companys profits from operations alone without taking into account income and expenses that arent related to the core activities of the business. While you may pay more for a business in an industry with high multiples its also more likely to hold its value. Find Out Your SDE Multiplier.

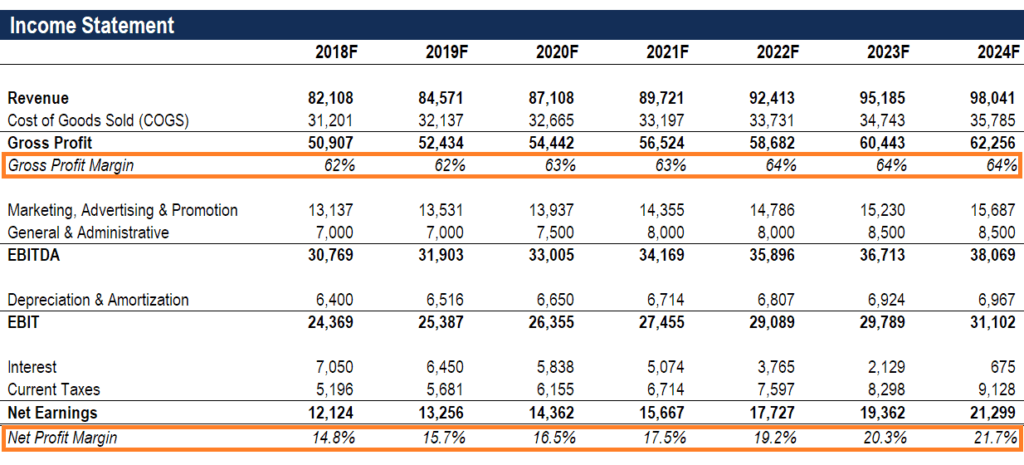

Net income is computed using the following calculation. Net income This is your companys income before tax. Second calculate the average and the median profit multiple from the data you gathered.

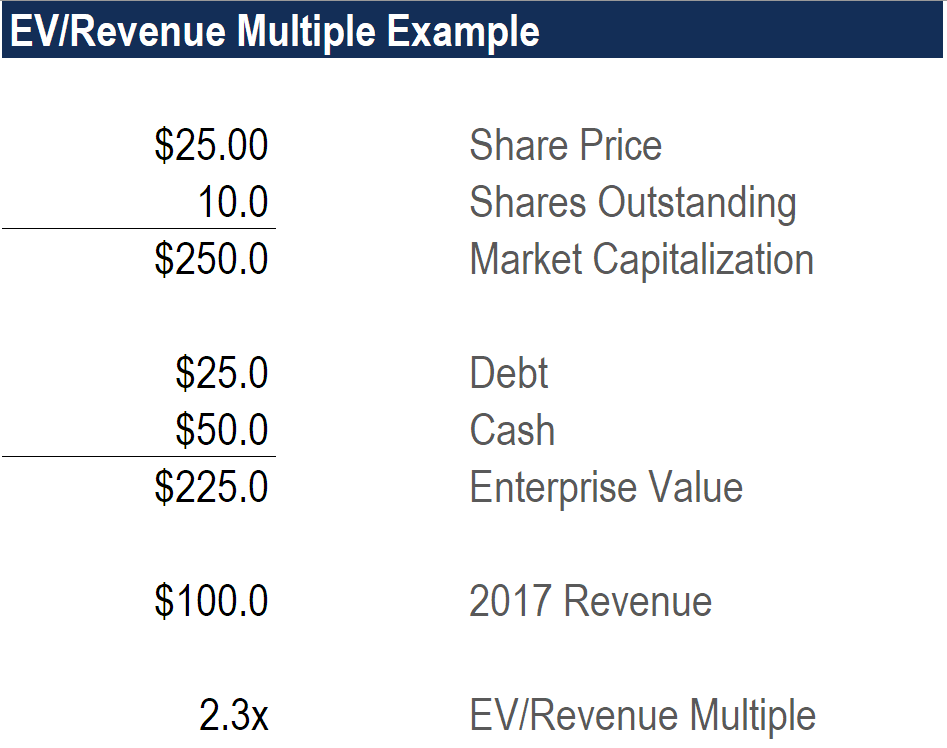

3 Tips For Buyers. If it does not include the net change in debt interest income and expense then enterprise value is used. How Is Net Operating Income Used for Company Valuation.

Add Business Assets Subtract Business. Now divide that net operating income by the capitalization rate to get the current value result. It depends on the metric that is being used to value a company.

If the metric includes the net change in debt interest income and expense then equity value is used. There are some national standards depending on industry type and business size. The reason that the equation goes into future years is to estimate a forward projection of the companys value taking into account all the growth prospects.

Since the forward projections of the companys net operating income. The key figures that are generally used to value a company include. To value a company based on profit first you gather the profit multiple of similar public companies.

For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. In profit multiplier the value of the business is calculated by multiplying its profit. Determine the capitalization rate from a recent comparable sold property.

Leverage The amount a potential buyer will need to borrow to buy your company. Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings. Hire a Business Broker.

The Ultimate Guide for 2020. Normally the numerator uses the free cash flow that the company generates in a year and in future years. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for.

This is the industry average youre going to use. Net income is a companys total bottom line profit and as such net income offers insight into the attractiveness of a business. Bizbuysell says nationally the average business sells for around 06 times its annual revenue.

Another useful net income number to track is operating net income. Net operating income would go on the numerator of the equation for company valuation. Calculate Sellers Discretionary Earnings SDE Most experts agree that the starting point for valuing a small business is to normalize or recast.

Youve determined that the propertys NOI after deducting applicable expenses is 50000. The intrinsic or fair value of a companys stock using the residual income approach can be broken down into its book value and the present. Find an Industry with Potential.

Third multiply that average profit multiple by the profit of the company youre valuing. Operating net income formula. Operating net income is similar to net income.

Margin This figure is worked out by dividing your net income by your revenue. How to Value a Business.

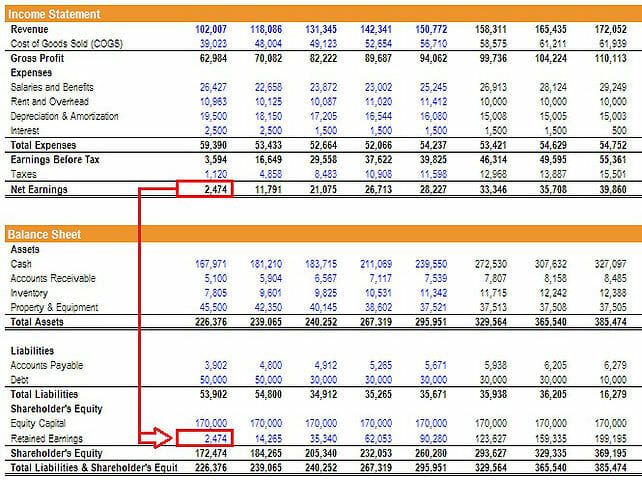

Net Income The Profit Of A Business After Deducting Expenses

Net Income The Profit Of A Business After Deducting Expenses

Gross Profit Margin Vs Net Profit Margin

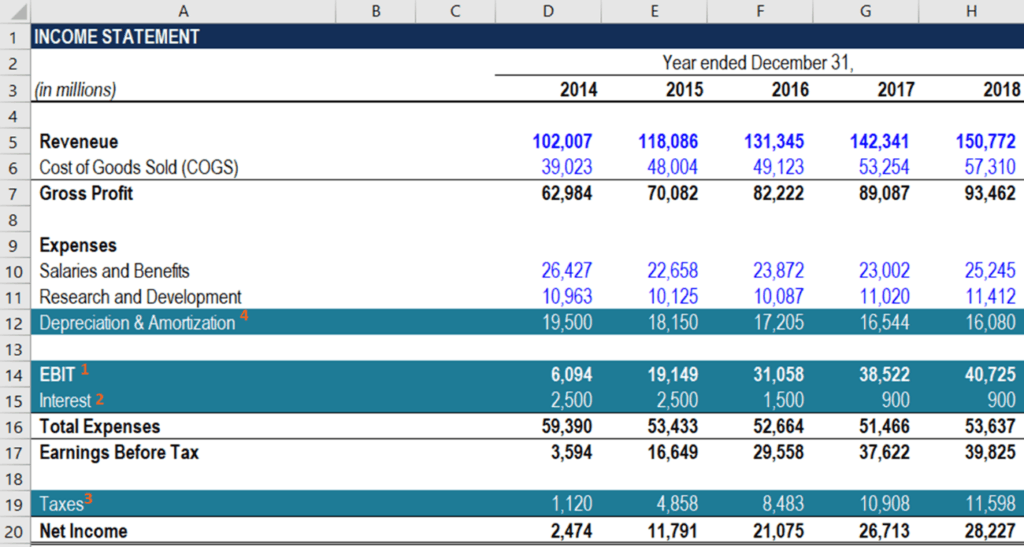

How Income Statement Structure Content Reveal Earning Performance

Net Profit Margin Definition Formula And Example Calculation

How To Calculate Fcfe From Ebit Overview Formula Example

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

Gross Profit Vs Net Income What S The Difference

Profit Margin Guide Examples How To Calculate Profit Margins

How Do Earnings And Revenue Differ

How Do Operating Income And Revenue Differ

Gross Profit Margin Vs Net Profit Margin

Net Income The Profit Of A Business After Deducting Expenses

Net Profit Margin Definition Formula And Example Calculation

How Do Net Income And Operating Cash Flow Differ

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income

:max_bytes(150000):strip_icc()/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "How To Value A Company Based On Net Income"