How To Get A Tax Id Number For A Small Business In Michigan

Request for Transcript of Tax Return. You must enter a individual name.

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Tax Refund Proposal Writer

Individual Tax Return Form 1040 Instructions.

How to get a tax id number for a small business in michigan. Doing them will help you establish that you are a farmer to be able to get an agricultural sales tax exemption. Begins With Exact Match Keyword Soundex. If your EIN has changed recently which could render any old documents useless you should definitely call the IRS.

The state sales tax rate is 6. Apply for a Michigan Tax ID EIN Number Online To begin your application select the type of organization or entity you are attempting to obtain a Tax ID EIN Number in Michigan for. If you want your LLC taxed as an S-Corp youll first apply for an EIN and then later file Form 2553.

Get a federal tax ID number Your Employer Identification Number EIN is your federal tax ID. Instead we have the GET which is assessed on all business activities. In order to register for sales tax please follow the application process.

Complete Treasurys registration application. Instructions for Form 1040 Form W-9. The ID number must be 6 or 9 digits in length.

These numbers are most commonly used to register a business with the federal and state government in order to pay sales taxes payroll taxes and withhold taxes from employee wages. Sales tax of 6 on their retail. International applicants must call 267 941-1099.

To learn more about the differences between the GET and sales tax. If you ever lose your EIN you can always call the IRS Business Specialty Tax Line at 800-829-4933. If all else fails and you really cannot find your EIN on existing documents you can reach out to the IRS by calling the Business Specialty Tax Line at 800-829-4933.

Search by Filing Number. Registering for a farm number filing your Schedule F and getting an agricultural land valuation all establish you and your farm. Hawaii does not have a sales tax.

The default tax status for a Michigan Multi-Member LLC is Partnership meaning the IRS taxes the LLC like a Partnership. The person applying online must have a valid Taxpayer Identification Number SSN ITIN EIN. This the preferred method for obtaining a tax ID number available for all business entities whose principal office or legal residence is in the US.

An application for a sales tax license may be obtained on our web site. You may apply for an EIN online if your principal business is located in the United States or US. This is the original document the IRS issued when you first applied for.

After completing the application you will receive your Tax ID EIN Number via e-mail. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Register for State and Local Taxes.

On the MTO homepage click Start a New Business E-Registration to register the business with Treasury for Michigan taxes. One of several steps most businesses will need to take when starting a business in Michigan is registering for an Employer Identification Number EIN and Michigan state tax ID numbers. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others.

Once you have a legal business structure you have a few options to get a tax ID number. Its easier to use a third party to handle the process of getting a tax ID number especially when you select a company with a. Search by Identification Number.

CityLocalCounty Sales Tax - Michigan has no city local or county sales tax. If the business has a federal Employer Identification Number EIN the EIN will also be the Treasury business account number. Check your EIN confirmation letter.

Make sure to call between the hours 7 am. Call the Business Specialty Tax Line at 800 829-4933 between 700 am. Get a Federal Tax ID Number Register with the Internal Revenue Service for an Employer Identification Number for federal tax purposes.

Local time Monday through Friday. However getting a farm number is NOT the same as getting agricultural tax exemption. When you call the representative will require some identifying information to ensure you are the person authorized to receive the EIN.

You are limited to one EIN per responsible party per day. In order to acquire a Michigan tax ID number through a third-party company you would need to pay any required fee which is typically between 20 and 30. Once you finalize your application and are assigned an EIN the number can never be canceled.

You need it to pay federal taxes hire employees open a bank account and apply for business licenses and permits. If instead you want your Michigan LLC taxed as a C-Corp youll first apply for an EIN and then later file Form 8832. You must enter a filing number.

Its free to apply for an EIN and you should do it right after you register your business. The easiest way to find your EIN is to dig up your EIN confirmation letter. Your accountant or financial institution may be able to help you obtain.

However if you find that you dont need the EIN the IRS can close your business. Retailers - Retailers make sales to the final consumer.

If You Are Looking Detroit Tax Attorney And Tax Attorney Michigan Visit Irs Wolf Irs Wolf Has A Professional Team W Tax Attorney Tax Forms Federal Income Tax

Https Www Michigan Gov Documents Uia Miwam Toolkit For Employers 473402 7 Pdf

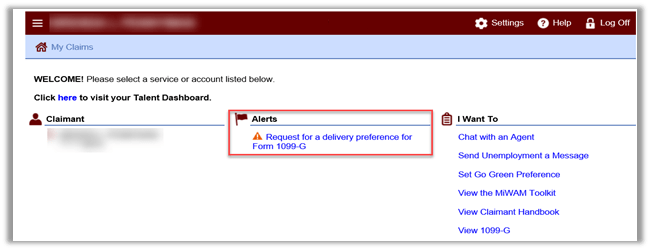

Labor And Economic Opportunity How To Request Your 1099 G

Free Michigan 7 Day Notice To Quit Form Pdf Word Template Treatment Plan Template Word Template Job Cover Letter

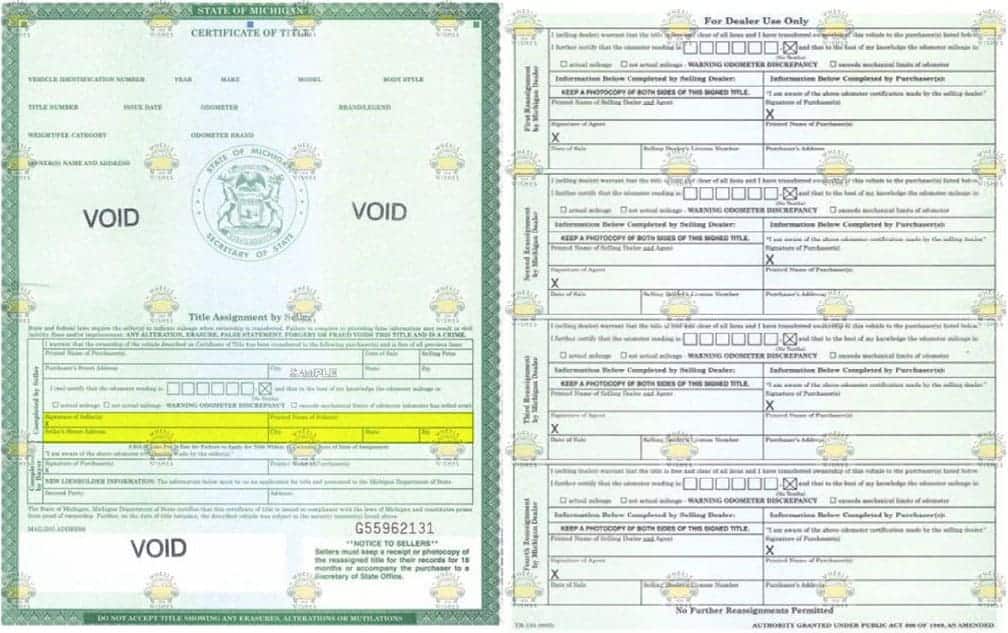

7 Doubts About Michigan Secretary Of State Business Search You Should Clarify Michigan Secretary Of State Busin Michigan Secretary Of State Business Michigan

Michigan Vehicle Title Donation Questions

How To Make Your Business Sound Unique Even When It S Not Business Advice Business Inspiration Business

How To Search Available Business Names In Michigan Startingyourbusiness Com

Employment Application Upper Peninsula Of Michigan Radio Yooper News Interviews Photos And Ca Employment Application Job Application Template Employment

![]()

Michigan Llc Name Search How To Start An Llc

Home Heating Credit Application Processing Begins Archive Of Mi Headlines Energy Bill Energy Low Income

How To Search Available Business Names In Michigan Startingyourbusiness Com

Buy Scannable Michigan Ids Driver License Online Drivers License Passport Online

Pin By Austin Larson Tax Resolution On Tax Services Debt Relief Programs Debt Relief Tax Debt

Https Www Michigan Gov Documents Uia Miwam Toolkit For Employers 473402 7 Pdf

Free Application Forms Free Michigan Complaint For Divorce Form Application Forms Divorce Forms Funny Dating Quotes Divorce

How To Search Available Business Names In Michigan Startingyourbusiness Com

Labor And Economic Opportunity How To Request Your 1099 G

Post a Comment for "How To Get A Tax Id Number For A Small Business In Michigan"