Business Entity Unit Irs

MS 6737 Ogden UT 84201 Fax. 1 Introduction to Federal Taxes for Small BusinessSelf-Employed.

3 11 154 Unemployment Tax Returns Internal Revenue Service

See Exhibit 4411-1 for instructions on completing Form 2363 for name and address changes.

Business entity unit irs. Form 1120 officially the US Corporate Income Tax Return is one of the IRS tax forms used by corporations specifically C corporations in the United States to report their income gains losses deductions credits and to figure out their tax liability. In a Practice Unit IRS has set out the best practice recommendations for examining a taxpayers treatment of corporate transaction costs ie costs that a taxpayer may incur such as legal accounting consulting or investment advisory service fees when executing a business transaction. For information regarding an FEIN contact the Internal Revenue Service IRS at.

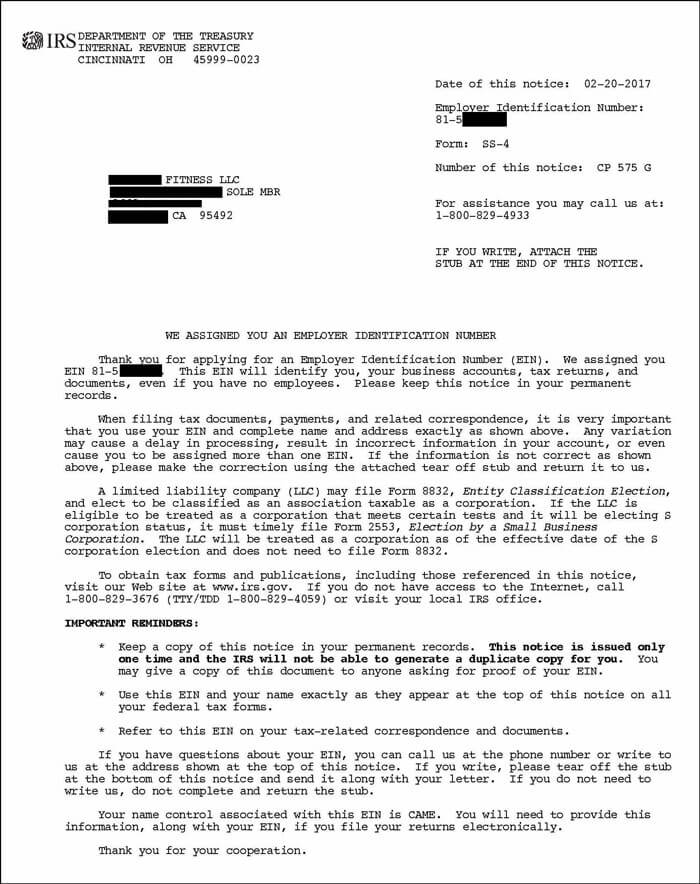

For purposes of IRS Form 8858 the tax code states a foreign business entity means a foreign corporation or foreign partnership. For Businesses Corporations Partnerships and Trusts who need information andor help regarding their Business Returns or Business BMF Accounts. The IRS will respond by sending a confirmation letter acknowledging the information changes associated with the EIN number.

An entity properly classified as a trust is not a business entity for tax purposes. And 2 A Virtual Small Business Workshop. 304 707-9785 Outside the United.

Entity Unit Cincinnati OH 45999 Further the IRS has developed two CD-ROMs to help educate small business owners. When a business incorporates the law recognizes the business as a distinct legal entity which can enter contracts and acquire property among other rights and privileges. 855 214-7519 Philadelphia PAMC International CAF MS 4H14123 2970 Market Street Philadelphia PA 19104 Fax.

Services cover Employer Identification Numbers EINs 94x returns 1041 1065 1120S Excise Returns Estate and Gift Returns as well as issues related to Federal tax deposits. CAF Units Fax Numbers and Mailing Addresses Ogden OAMC 1973 N. Nevada Business ID Number.

Scheduling Appointments Virtually To schedule an appointment at our main office in Montgomery Alabama click here. When a change in marital status occurs during an examination or Surveyed Claim Disposal Code 34 mailfax Form 2363 to CCP to change the marital status filing status code on the Master File. Enter your Federal Tax Identification Number FEIN.

The IRS also provides wwwirsbusinessessmall. Franchise Tax Board PO Box 942857 Sacramento CA 94257-0501 For overnight or express via UPS FedEx etc mail to. Is the business an LLC and will be filing as a corporation.

Foreign legal constructs such as foundations and establishments are generally treated as foreign trusts for US. The Business Entities Section of the Secretary of States office processes filings maintains records and provides information to the public relating to business entities corporations limited liability companies limited partnerships general partnerships limited liability partnerships and other business filings. Business Entity Video Unit MS L160 Franchise Tax Board 9646 Butterfield Way MS.

In other words a foreign. Business entity simply refers to the form of incorporation for a business. IRS Procurement provides acquisition services for all business units of the IRS and other bureaus and offices within Treasury.

Internal Revenue Service MS 6273 Ogden UT USA 84201. Procurement contracting professionals deliver quality service and support throughout the acquisition life cycle from planning to close out. If a confirmation letter is not received within sixty 60 calendar days then fax the same letter to the appropriate office depending on what state or country the principal location office or agency of the business or entity.

Business Entity Correspondence Franchise Tax Board PO Box 942857 Sacramento CA 94257-4040. These two CD-ROMs are free and can be ordered by calling 1-800-829-3676. The Entity Registration Unit assists taxpayers registering their new entity or making changes to their existing entity.

Limited liability companies and corporations are common types of legal entities. Federal Tax Identification Number. Two or more owners the IRS will by default treat it as a partnership unless the entity makes an election to have it treated as a corporation.

Where to Mail Print and mail the form with your check to. Enter the number shown on your State Business License or exemption issued by the Secretary of State. Only one owner the IRS will by default treat it as if it were a sole proprietorship disregarded entity unless the owner makes an election to have it treated as a corporation.

Additionally the Unit ensures entities pay the appropriate fees and taxes. However such foreign trusts when organized to operate a business are treated as business entities rather than as trusts. 2 However under the authority of sections 6011 6012 6031 and 6038 of the Internal Revenue Code and Treasury Regulation 1367a-6Tg the instructions to IRS Form 8858 state that Form 8858 must also be filed for a foreign branch 3.

Fill out the online revivor assistance request form if you need revivor assistance. Select Y or N. 855 214-7522 Memphis MAMC 5333 Getwell Rd Stop 8423 Memphis TN 38118 Fax.

For information on reviving a limited partner LP visit our Partnerships page.

What Is A Cp05 Letter From The Irs And What Should I Do

3 13 2 Bmf Account Numbers Internal Revenue Service

Sole Proprietorships Sole Proprietorship Business Internal Revenue Service

Https Www Irs Gov Pub Irs Pdf P5370 Pdf

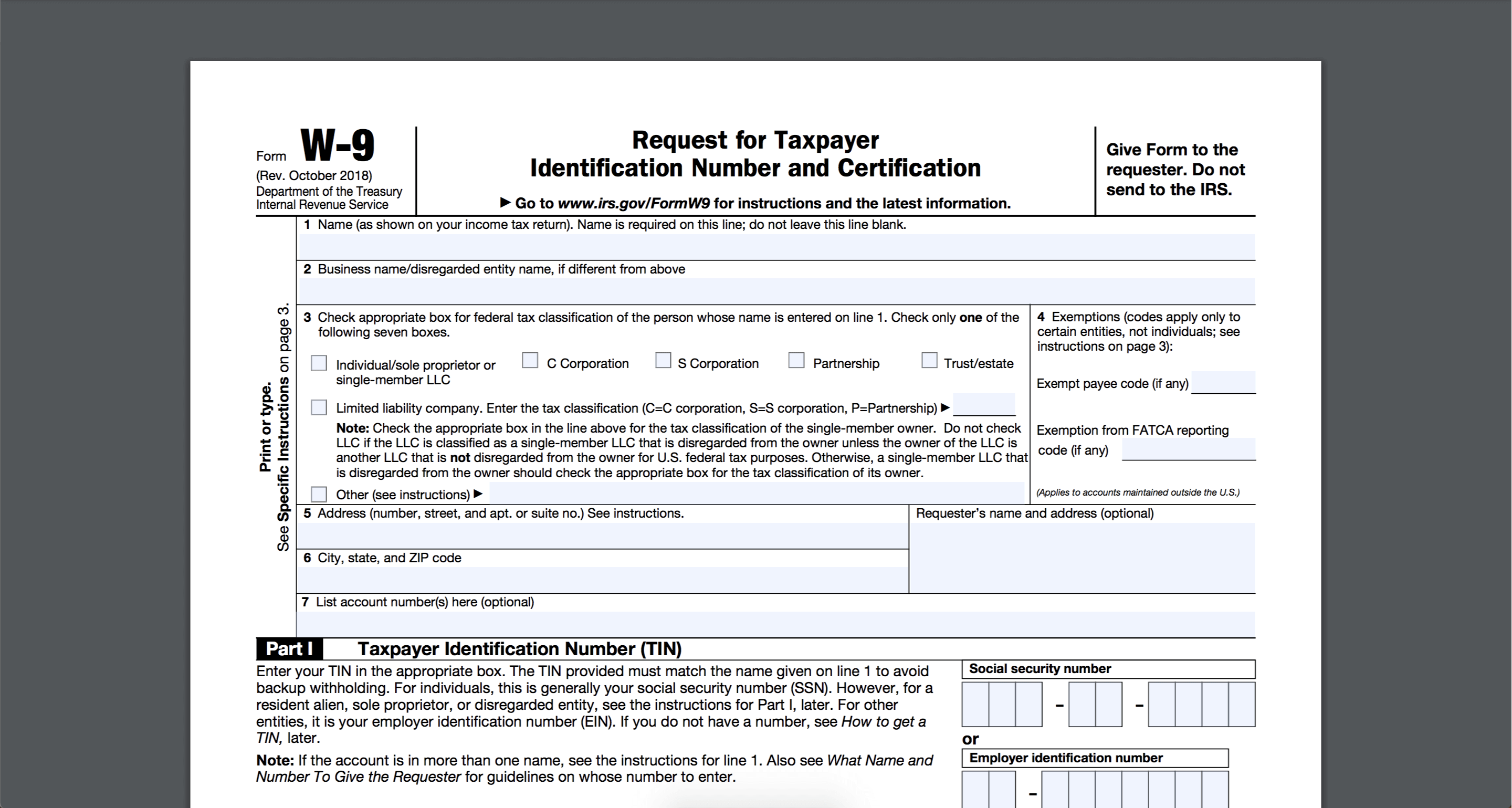

Downloadable Form W 9 What Is Irs Form W 9 Turbotax Tax Tips Videos Tax Forms Irs Forms Fillable Forms

1 1 1 Irs Mission And Organizational Structure Internal Revenue Service

Change Your Business Name With The Irs Harvard Business Services

How To Apply For An Ein For Your Llc Online Step By Step Llc University

Irs Form 8802 Application For United States Residency Certification

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

Irs Form 56 Instructions Overview Community Tax

Irs Audit Techniques Expatriation Tax Expatriation

How To Fill Out And Sign Your W 9 Form Online

3 13 2 Bmf Account Numbers Internal Revenue Service

What Is A Cp05 Letter From The Irs And What Should I Do

Ask Gusto What Is A W 9 How Do I Fill It Out Paying Student Loans Employer Identification Number Student Loan Interest

Irs Login Irs Login Internal Revenue Service

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Llc Vs Sole Proprietorship Here We Provide You With The Top 7 Differences Between Llc Vs Sole Proprie Sole Proprietorship Real Estate Tips Small Business Tips

Post a Comment for "Business Entity Unit Irs"