K1 Qualified Business Income

To enter the Qualified business income QBI information from Schedule K-1 in TaxAct. Qualified Business Income Deduction.

Solved K 1 Schedule Need Help Re Entering Qbi Data For

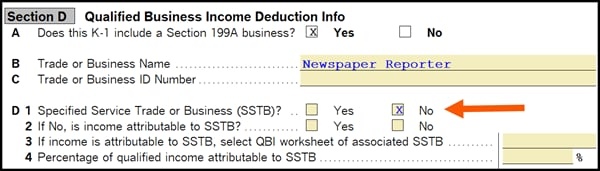

If you are reporting income from a partnership K-1 schedule form 1065 then you would need an entry in box 20 with code A AA AB AC or AD of the K-1 schedule to qualify for a QBI deduction.

K1 qualified business income. Qualifying taxpayers include those with a domestic business operated as a sole proprietorship or income received through a partnership as a partner S corporation as a shareholder or from a trust or estate as a beneficiary. Schedule K-1 Form 1065 Box 20 Code Z Qualified Business Income Schedule K-1 Form 1120S Box 17 Code V Qualified Business Income Schedule K-1 Form 1041 Box 14 Code I the fiduciary is required to provide a statement to the beneficiary with the Schedule K-1 Form 1041 that specifies the portion of income that has been allocated to the beneficiary that is Qualified Business Income. Generally you may be allowed a deduction of up to 20 of your net qualified business income QBI plus 20 of your qualified REIT dividends also known as section 199A dividends and qualified publicly traded partnership PTP income from your S corporation.

Youll fill out Schedule K-1 as part of your Partnership Tax Return Form. On smaller devices click in the upper left-hand corner then click Federal. Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017.

QBI per IRC 199A c 1 is the net amount of qualified items of income gain deduction and loss with respect to any qualified trade or business of the taxpayer. Generally taxpayers can deduct 20 of QBI qualified cooperative dividends qualified REIT dividends and qualified publicly traded partnership PTP income. In other words at best a taxpayer will be able to ultimately deduct 20 of QBI.

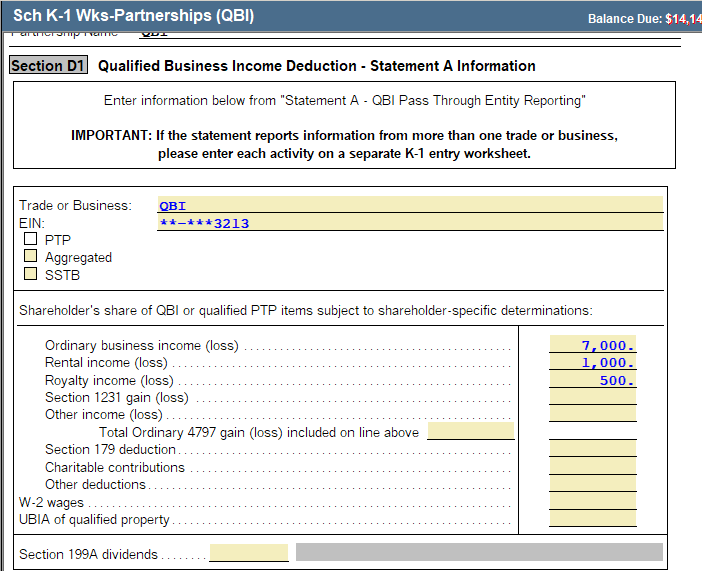

Code Z Ordinary Business Income and code AA W-2 Wages were not flowing through to the Form. The qualified business income talked about in Section 199Athats the new section of law that creates the deductionincludes the profit from an active trade or business including rental income as long as you operate as a pass-through entity. Basically it is the taxable net income.

The qualified business income deduction QBI deduction allows some individuals to deduct up to 20 of their business income REIT dividends or PTP income on their individual income tax returns. In 2018 the taxable income thresholds were 315000 for joint returns and 157500 for other filers. No 20 deduction was being calculated or applied.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified. Depending on the taxpayers taxable income the QBID may be further reduced below 20 of QBI. Eligible individuals will likely receive Schedule K-1 to help file their taxes.

QBID is generally available to most taxpayers with pass-through business income whose 2019 taxable income is at or below 321400 for married filing jointly 160725 for married filing separately and 160700 for all other fliers. The deduction which an S Corp shareholder can take is the lessor of 20 of QBI OR the. Its a way for individual taxpayers to reduce their tax liability with qualified business income QBI they receive from partnerships S corporations and sole proprietorships.

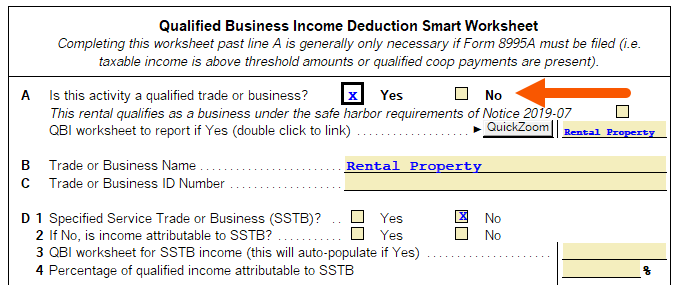

It also includes farms and certain rental properties that rise to the level of a. Click Business Income in the Federal Quick QA Topics menu to expand then click S Corporation income Form 1120S Schedule K-1. After manually entering the Ordinary Business Income and W-2 Wages in Section D1 on the K-1 Form a Schedule E was automatically created and the 20 deduction was applied.

To enter qualified business income in TaxAct. Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS. Per the Instructions for Schedule K-1 1065 page 18.

But more specifically it is the net amount of income gain deduction and loss from your business. On smaller devices click in the upper left-hand corner then click Federal. The deduction allows an individual to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP.

Qualified business income QBI is essentially your share of profits from the business. Complete Form 8995 or Form 8995-A to claim the tax deduction. Section 199A allows S Corp shareholders to take a deduction on qualified business income QBI.

The S corporation will provide the information you need to figure your deduction. From within your TaxAct return Online or Desktop click Federal. If you are a Partner or Shareholder and file Schedule K-1 on your individual tax return you may be able to claim the Qualified Business Income Deduction QBID on that income.

Once incorporated TurboTax Deluxe will calculate the qualified business income deduction QBI from your K-1 entries. From within your TaxAct return Online or Desktop click Federal. Generally you may be allowed a deduction of up to 20 of your net qualified business income QBI plus 20 of your qualified REIT dividends also known as section 199A dividends and.

The qualified business income deduction is limited to 20 of qualified business income.

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

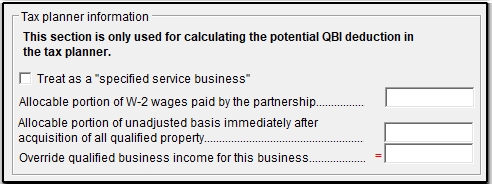

1040 Tax Planner Qualified Business Income Deduction Drake17

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

Staying On Top Of Changes To The 20 Qbi Deduction 199a One Year Later Wffa Cpas

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

How To Enter And Calculate The Qualified Business Intuit Accountants Community

1040 Tax Planner Qualified Business Income Deduction Drake17

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Post a Comment for "K1 Qualified Business Income"